Embark on a journey through the realm of personal finance apps tailored for the digital lifestyle, exploring their key features, user interfaces, and security measures that safeguard financial data in the digital age.

Delve into how these apps revolutionize budgeting, expense tracking, investment, savings, automation, and integration for individuals navigating the digital financial landscape.

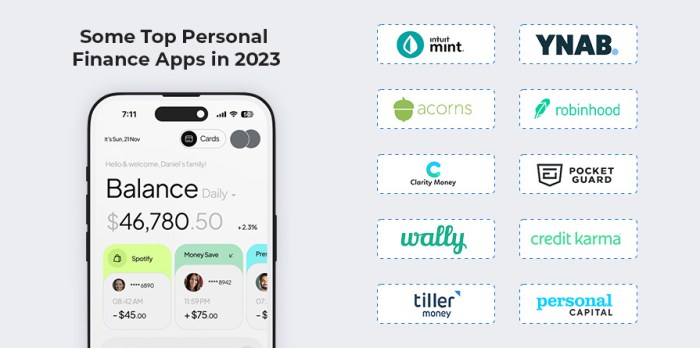

Top Personal Finance Apps for Digital Lifestyle

In today's digital age, managing personal finances has become more convenient with the help of various mobile apps. These apps are designed to cater to the needs of digital-savvy individuals who prefer managing their finances on-the-go through their smartphones or tablets.

Let's explore the key features of some of the top personal finance apps tailored for a digital lifestyle.

Key Features of Personal Finance Apps

- Expense Tracking: These apps allow users to track their expenses in real-time, categorize them, and set budget limits to manage spending effectively.

- Bill Reminders: Users can set reminders for bill payments to avoid missing due dates and incurring late fees.

- Financial Goal Setting: Many apps offer tools to set financial goals, whether it's saving for a vacation, purchasing a home, or building an emergency fund.

- Investment Tracking: Some apps provide features to track investments, monitor portfolio performance, and analyze market trends.

User Interface and Security Measures

Personal finance apps prioritize user-friendly interfaces to ensure smooth navigation and easy access to financial information. These apps often feature intuitive dashboards, customizable reports, and interactive charts to help users visualize their financial data effectively.

When it comes to security, these apps implement robust measures to protect sensitive financial information in the digital realm. This includes end-to-end encryption, multi-factor authentication, biometric login options, and regular security updates to safeguard user data from potential cyber threats.

Budgeting and Expense Tracking

Managing a budget and tracking expenses are crucial components of maintaining financial health in a digital lifestyle. Personal finance apps offer innovative tools to assist users in creating and sticking to a budget while providing real-time tracking of expenses.

Tools for Budgeting and Expense Tracking

- Expense Categorization: These apps allow users to categorize their expenses, making it easier to see where the money is being spent.

- Budget Setting: Users can set monthly budgets for different categories and receive alerts when they are close to exceeding them.

- Transaction Tracking: Real-time tracking of transactions helps users stay on top of their spending habits and identify areas where they can cut back.

- Analytical Insights: Apps provide detailed reports and insights into spending patterns, helping users make informed financial decisions.

Investment and Savings Tools

When it comes to managing your finances, investment and savings tools play a crucial role in helping you grow your wealth over time

Investment Options

- Stocks: Many personal finance apps offer the ability to invest in individual stocks or ETFs, allowing users to build a diversified investment portfolio.

- Mutual Funds: Users can also invest in mutual funds through these apps, which provide a convenient way to access a professionally managed investment portfolio.

- Robo-Advisors: Some apps offer robo-advisor services, using algorithms to create and manage an investment portfolio based on the user's financial goals and risk tolerance.

Setting Financial Goals

These apps help users set specific financial goals, such as saving for a down payment on a house, building an emergency fund, or planning for retirement. By inputting their goals and desired timeframes, users can track their progress and make adjustments as needed.

Saving and Investing Strategies

- Automatic Transfers: Apps often allow users to set up automated transfers from their checking account to a savings or investment account, making it easier to save consistently.

- Round-Up Features: Some apps round up each purchase to the nearest dollar and invest the spare change, helping users save without even realizing it.

- Diversification: These apps often emphasize the importance of diversifying investments to reduce risk and maximize returns over the long term.

Automation and Integration

Automation features in personal finance apps play a crucial role in streamlining financial tasks for users leading a digital lifestyle. These features help users save time and effort by automating repetitive processes and transactions.

Integration Capabilities

Personal finance apps often offer integration capabilities with other financial accounts and platforms, allowing users to have a comprehensive view of their finances in one place. This integration simplifies the process of tracking income, expenses, investments, and savings across multiple accounts.

Closing Notes

In conclusion, the world of personal finance apps for digital lifestyle offers a myriad of tools and strategies to empower users in managing their finances efficiently and securely in today's digital era. Dive in, explore, and take control of your financial well-being with these innovative apps at your fingertips.

FAQ

How do personal finance apps help in setting financial goals?

Personal finance apps assist users by providing goal-setting features that allow them to define specific financial objectives, track progress, and adjust strategies accordingly.

Are personal finance apps safe to use for managing financial data?

Yes, most personal finance apps implement stringent security measures such as encryption, two-factor authentication, and secure data storage to protect users' financial information.

Can personal finance apps be integrated with other financial accounts?

Absolutely, many finance apps offer integration capabilities with various financial accounts and platforms, providing users with a holistic view of their financial status.

![Top Must-Have Smart Home IoT Devices [2024 Curated]](https://digital.bantenraya.com/wp-content/uploads/2025/10/aee64388c1cfecaae116a4d593f27dfa-120x86.jpg)